OPINION: We now have premium EVs in Malaysia – but where are all the affordable electric cars you can buy?

Source: paultan.org

The recently-launched BMW iX made headlines recently, and we even called it a bargain. But, at RM420k, it’s not exactly affordable. Here and now, we seem to have options for premium/luxury EVs in Malaysia. For example, BMW Group will have not one, but four EVs in the near future. However, the cheapest one, the MINI Cooper SE, costs RM213k. For a small EV with 230 km range, that’s a premium offering.

Then there’s the Porsche Taycan. Priced from RM585k, it appears reasonable enough, especially given the looks, performance and brand cachet. But for all its gloss and accomplishment, you can’t deny it is a toy for the well-heeled.

The only somewhat affordable EV available in Malaysia is the Nissan Leaf, and even that is priced at RM181k, which isn’t exactly affordable either. Speaking of which, when was the last time you saw one on Malaysian roads, or have you even, ever?

Before that, Renault tried with the Zoe (RM146k) in 2016, but only sold a handful. There was also the Twizy at around RM70k, but that wasn’t quite a car, as it didn’t even have windows. There was also the Mitsubishi i-MiEV (RM136k) from 2013, but with a paltry 150 km range (more like 100 km in the real world), it wasn’t a surprise that it didn’t catch on.

So the question is, where are our affordable electric cars, and why can’t you get your hands on one? Why are EVs reserved only for the privileged here in Malaysia? There are many answers to this, none of which are pretty.

Before we delve into it, let’s take a look at EVs in other markets and how they are priced compared to ICE models. To simplify things, we’ll use the UK market as a sampling plate. We’ll list it down in direct fashion to make it easier to digest.

- The Honda e is priced at GBP28k (RM160k) vs the similarly sized Jazz, which is under GBP20k (RM115k). That’s 40% more for the electric.

- The Nissan Leaf is GBP26k (RM150k) vs the closest ICE model, the Juke. at GBP19k (RM109k). 37% more.

- The VW e-up! is GBP24k (RM138k) vs the ICE-powered up! at GBP14k (RM80k). 73% more.

- The Peugeot e-208 is GBP27k (RM155k) vs the normal 208 at GBP18k (RM103k). 50% more.

- The Renault Zoe is GBP28k (RM160k) vs the Clio at GBP16k (RM92k). 75% more.

- The Hyundai Kona Electric is GBP28k (RM160k) vs normal Kona at GBP21k (RM121k). 33% more.

- There’s no Toyota example, since Toyota still doesn’t have any EV outside of China, instead pushing its hybrid tech.

Generally EVs are significantly more expensive than their ICE equivalents. In the UK, the difference is between 30% to 75% more for an electric version. Apply that to the very price-sensitive Malaysian market and it’s easy to see why it won’t work. The reasonably priced Nissan Leaf here is proof of that.

Surely not all EVs are expensive. I’ve seen really cheap ones on the Internet. Yes, but…

There’s a good reason why we looked at the UK market, because we’d end up with brands and models you’d be familiar with, and we’d also skip over EVs that, uh, while more affordable, just wouldn’t be accepted by Malaysian buyers.

Take the Wuling Hong Guang Mini EV, which recently made headlines for outselling the Tesla Model 3 in China. Its RMB38k (RM24k) price made sensational news, but look closer and you’d notice that it has a tiny 9.3 kWh battery and a total range of 120 km. Its sub-three metre size would also make a Perodua Kancil look like an Alphard in comparison.

Just last year, a company selling a so-called Mini EV X2 in Malaysia (for as low as RM13.8k) went viral for all the wrong reasons. This “car” has a top speed of 50 km/h, and as it turns out, cannot even be driven legally in Malaysia.

Before you say we are just bad mouthing Chinese EVs, we’re not. There is a long line of very decent EVs sold in China, but they’re also priced as you’d expect – more than conventional internal combustion engine (ICE) cars.

Two of the best selling EVs in China (other than Teslas) are the GAC Aion S, which is priced from RMB160k (RM102k), and the BYD Han EV, at RMB230k (RM148k). There are also more premium offerings such as the Li Xiang One SUV and the XPeng P7, both priced at RMB338k (RM217k).

The point is, while there are very affordable EVs sold in China, they simply would not work here in Malaysia. The ones that you’d actually want to drive are priced considerably more, and are generally more expensive than normal cars – just like the UK examples we provided above.

Okay, if you think that’s hogwash, let’s take the Indian EV market, which is just as interesting. Recently updated is the Tata Tigor EV, which is an entry-level electric sedan with 306 km range and affordably priced at INR1.199 million (RM68k). This is a typical sub-four metre car made specifically for India, and yes, is substantially more expensive than the petrol Tigor it’s based on, which starts from just INR565k (RM32k).

Closer to home, there’s the MG EP EV on sale in Thailand for THB988k (RM133k). This is a no-frills C-segment EV in wagon form, and is perhaps one of the strongest form of an affordable EV in our region. Its 380 km range and boring but modern enough looks make it a reasonable option for Malaysia, if we can accept the price (it’s bound to go higher if it comes here, mind you), looks and brand, that is.

As mentioned above, Malaysia is a very price-sensitive market, and a brand-conscious one at that too. That’s a tough nut to crack, as you’ll see below.

The Malaysian car market is very price-sensitive – demands new tech but at lower prices

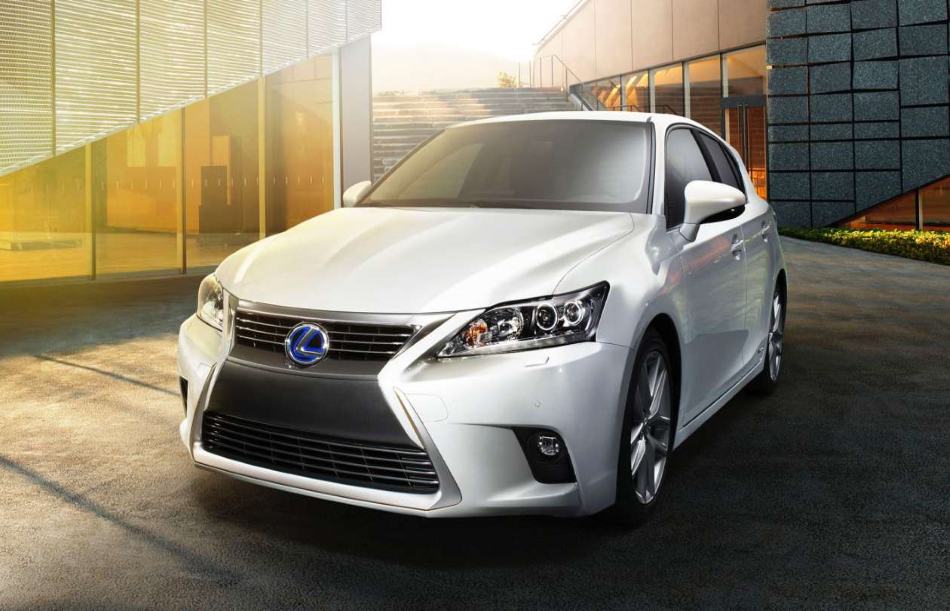

Before EVs, came hybrids. Special hybrid incentives made hybrid models relatively popular in Malaysia, as they were attractively priced. Prime examples were the Toyota Prius c and Honda Jazz Hybrid. Higher up the chain came the Lexus CT200h and Audi A6 Hybrid (of which nearly half the global production ended up being sold here in Malaysia).

Then, the hybrid incentives were moved to CKD hybrids only. With price hikes, the CT200h and Prius c disappeared from Malaysia, leaving a handful of CKD hybrids. These few include the Honda Jazz Hybrid, Hyundai Ioniq Hybrid and various premium models from BMW, Mercedes and Volvo.

Unfortunately, because of the first round of tax-free hybrids, Malaysians have come to expect hybrid models to be cheap, or at least cheaper than their petrol-only equivalents. Which is not always the case.

Hybrids have more parts than their petrol counterparts, and are obviously more expensive to produce. Yet, Malaysians expect them to be cheaper. And cheaper they continued to be, at least for the most part. But, car companies have had to make compromises to ensure that went the way it did.

Honda had to artificially down-spec their hybrid models to keep their prices down, i.e. not be more expensive than the range-topping variants. This meant that the Jazz Hybrid and City Hybrid as well as the HR-V hybrid were specified closer to E grade rather than V grade petrol versions, just so they could be priced lower.

Even then, Malaysians saw little value in all this, as the Honda hybrids were priced around the same as the top-spec V models (or just a few hundred less), but offered less in terms of kit. Sales were slow, and in the case of the Jazz Hybrid, nowhere near the volume achieved by the original.

Honda Malaysia finally gave up playing that game, and its latest City e:HEV is now positioned as the model’s top dog in this current generation, which is where it naturally belongs; it’s also how the hybrid variant is placed in virtually all other markets. The result? It only makes up 3% of the latest City’s sales.

With premium cars, the margins were a lot bigger, so they could play the pricing game better. Early on, BMW made full use of this to push its PHEV models, to the point that BMW Malaysia had the largest share of hybrids around the world at one point.

But even at this level, consumers still expected hybrids or PHEVs to be cheaper than their petrol equivalents. After all, a 530e should be cheaper than a 530i, because hybrids have less tax, right?

So far, BMW Malaysia has managed to keep its PHEV prices lower, but it has done so in a rather artificial way. Just like Honda, BMW down-specced its hybrids to keep the e variants as the “value” models. For example, the 330e is specified significantly lower than the 330i.

Mind you, this is a unique situation compared to global markets, as PHEV models are generally priced more than their petrol equivalents. In Germany, the 330e and the 530e are more expensive than the 330i and 530i siblings, respectively. However, that convention won’t be accepted in Malaysia, because we’ve come to expect hybrid cars to be cheaper.

So even with PHEVs, it’s come to a point that these hybrid incentives are only benefitting premium brands, so only the more affluent can enjoy them. Yes, the 330e is cheaper than the 330i, but it’s still a RM250k car.

Back to the main point. Malaysian consumers are a demanding bunch. Give us the latest technologies, and give them to us cheap, and only then will we buy into it.

This happened with the hybrids, and they are expecting the same to happen with EVs. Price them super cheap, as in no more than the petrol cars, and then we’re talking. Well, if you look at the UK price comparisons we’ve laid out above, that’s just not going to be possible.

EEV – no more special incentives for hybrids, let alone EV

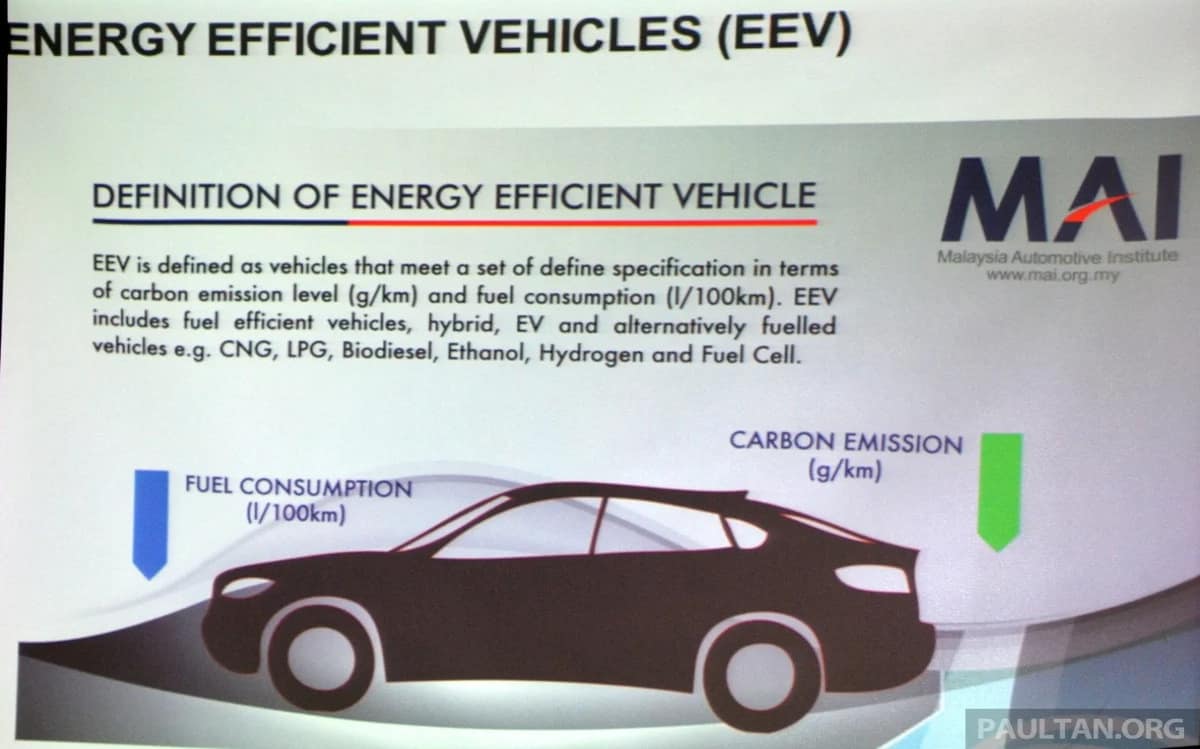

This issue was then made worse, because just as soon as the initial hybrid incentives were changed to CKD hybrids, the Malaysian government made yet another u turn to favour CKD in general. Welcome to the confusing energy efficient vehicle (EEV) era.

With the rating, it no longer matters if a car is a hybrid or petrol anymore. As long as it consumes less fuel (or is “energy efficient”), then it will get EEV incentives. There was also supposed to be a measurement of exhaust emissions, as announced in 2014, but that hasn’t been implemented yet, seven years on.

In all of this, there was little mention of EVs at all. It all felt like something that was too far into the future at that point in time (2014).

So now, technically, as long as a car can hit the fuel consumption targets (different threshold, depending on weight) – regardless of whether it’s electrified or not – it will get EEV status, get taxed less, receive additional incentives, and therefore be priced cheaper.

Perodua has been a master of this. Its entire range is EEV certified, and obviously we know none of it is electrified. This gives near zero incentive, pun intended, for Perodua to push for hybrid tech, let alone EVs.

After all, going hybrid will only add on to R&D costs, manufacturing costs (more complex components, batteries), and likely long-run maintenance costs too. Without any additional incentives from the government, all this will naturally lead to higher sticker prices. As we’ve explained above, that will not fly with Malaysians. Hybrids need to be cheaper, remember?

As for Proton, its PIES models can’t even get EEV status yet, so they’re a long way back. A jump straight to EVs is possible, especially with Geely technology, but again the lack of clarity with the NAP is stalling this idea.

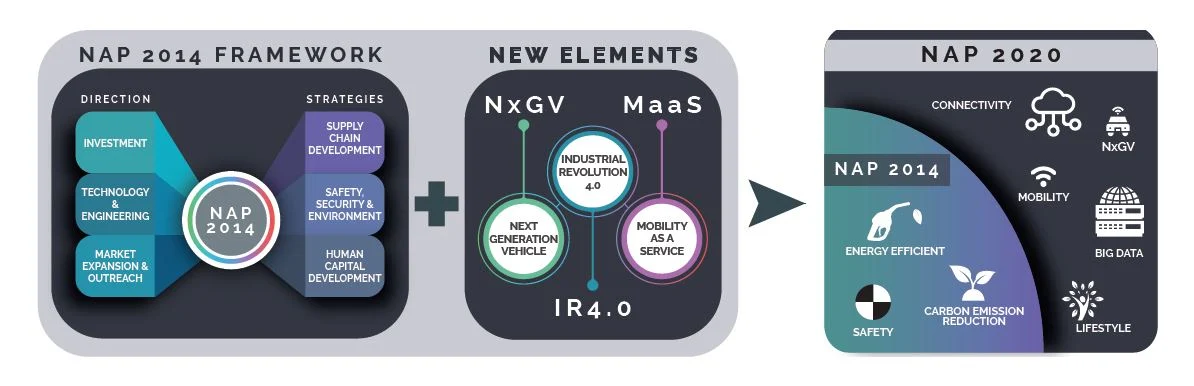

NAP 2020 – all talk about nothing. No clarity, car brands can’t commit to anything

Speaking of that, there was an update to the NAP in 2020, announced just before Covid-19 hit and before a change of government (the first round) came about. The policy made bold claims of bringing the Malaysian automotive industry to the next level, and promised to “make Malaysia the regional automotive leader.”

It covered vague (and canggih-sounding things like NxGV that carry little meaning in the real world) policy directions for hybrid, electric and fuel cell vehicles in Malaysia.

Crucially, however, NAP 2020 was nothing more than a simplistic “here’s what we want to achieve” canvas rather than a definitive “here’s what we’re going to do to achieve it” mural. With the ensuing government change, no update has been given since, so everything is still up in the air, with no new policy yet in terms of an EV – and hybrid – direction.

Of course, while the Malaysian automotive industry has had to hit pause while waiting for the government to sort itself out and provide clarity on any future or upcoming policies, the rest of the world continued chugging along.

If you are not moving forward, you are moving backward, Mikhail Gorbachev said long ago. How apt it is to describe our situation when it comes to electrification.

With no clarity on how things are going to be shaped, car companies in Malaysia are left helpless in terms of future planning. How would you plan for the next five to 10 years if you have zero idea on how the national auto policy will shape up in the near future?

Imagine the situation. Yes, we have this fantastic EV product that Malaysians would love, so we should definitely plan for it, right? But wait a minute, how can we do that, if we don’t know how we will be able to price it? We can assume the new policies will allow EVs to be priced cheaper than now, but by how much? Can they be brought close enough to ICE models to make it economically viable, seeing how price sensitive the Malaysian consumer is?

It’s an endless pit, really. What’s clear is this: without clarity, no company will commit to anything in Malaysia. Why should they, when our neighbouring countries have clear-cut policies that incentivise car companies to invest there instead?

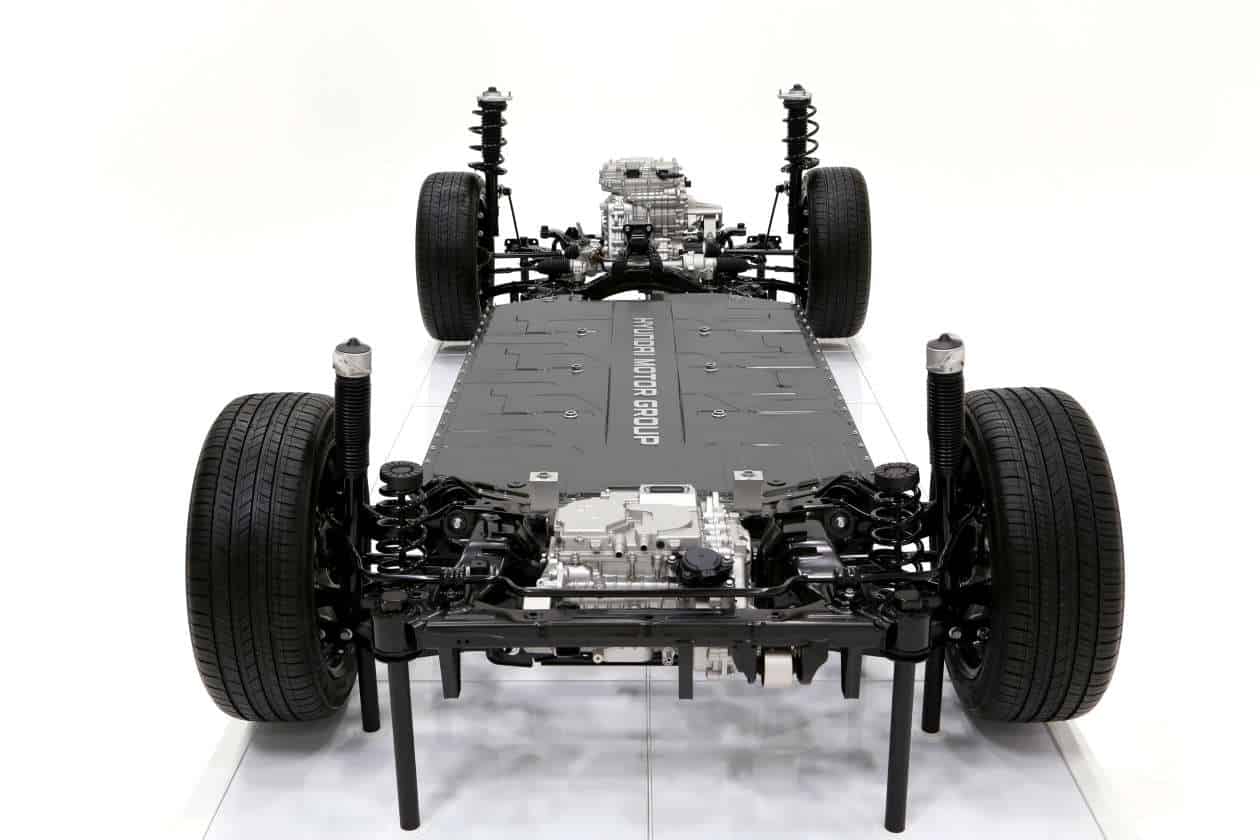

As it is, we have Mercedes-Benz building a battery plant in Thailand, and Hyundai committing to do the same in Indonesia. All this time, Malaysia is losing out. With no clear policy regarding the future of EVs, Malaysians are not getting affordable EVs today, and unfortunately, likely not tomorrow either.

Even if we get CKD EVs, local content will be low as the battery packs have to be imported in. Low local content will mean less incentives, and higher prices

The way CKD operations work in Malaysia is generally like this – the more you do/make here, the more incentives you will get. This is why local content is a popular buzz word among carmakers.

Perodua proudly shouts that its cars have 95% local content, which is why it generally has a price advantage over other carmakers in Malaysia. But, sell the same exact car in other markets, like Indonesia for example, and the pricing becomes far less competitive. All that “local content” becomes irrelevant, as it all becomes “imported content” in the Indonesian context.

Take the Indonesian-market Daihatsu Sirion, which is basically a Myvi, made in Malaysia and imported over. There, it’s priced from IDR202 million (RM59k), which is more than the Indonesian-made Rocky at IDR189 million (RM55k). Remember, the Rocky is essentially the Ativa, which is positioned higher than the Myvi here.

This goes to show just how important local manufacturing, assembly and, by association, government incentives are when it comes to getting competitive pricing for cars. Essentially, the general idea is this: more local content, more incentives, cheaper selling price.

With EVs, things are going to get more complicated. As mentioned above, more and more companies are setting up battery plants in our neighbouring countries. The same cannot be said about Malaysia.

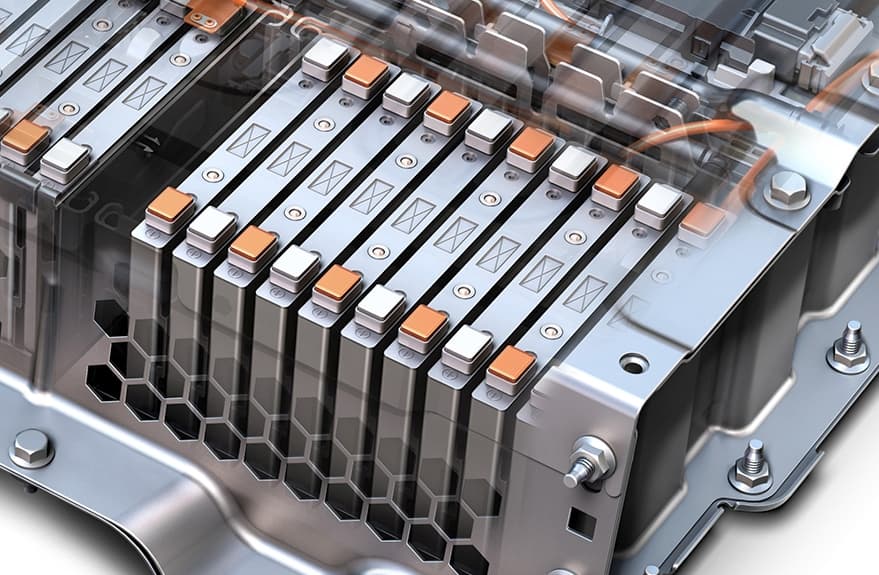

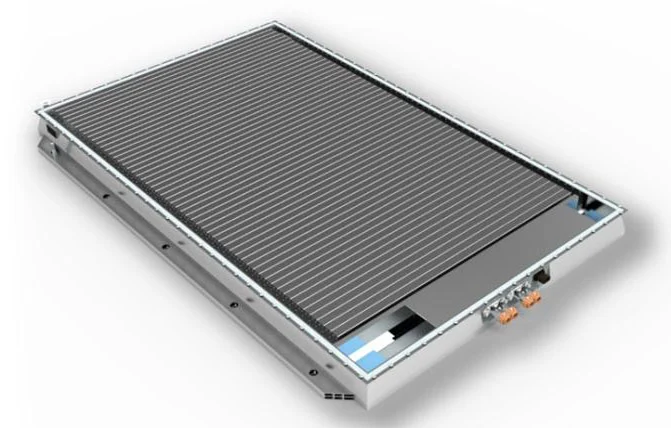

These batteries make up the bulk of the cost of EVs. Remember, EVs have less mechanical parts compared to a traditional ICE vehicle, and it’s common knowledge that the battery pack makes up a substantial amount of the costs associated in building an EV.

How much? Well, a Financial Times research paper published in 2020 estimated that the battery alone makes up of 40% of the total costs to produce an EV – the biggest cost factor by far. The FT study also concludes that EVs, in general, cost around 45% more compared to an equivalent ICE vehicle. This tallies well with our price comparisons above (if you remember that far back, that is).

So, as these batteries will have to be imported into Malaysia, carmakers are already losing a significant chunk of local content-related incentives. Having to import larger components leads to further tax and cost implications too.

Put the two and two together and you’ll come to the unfortunate conclusion: EVs will be expensive in Malaysia, even if car companies dare to CKD them. They’re generally more expensive to make in the first place, and with less local content comes less incentives, and thus higher prices.

That is unless the local carmakers come into play, and soon.

If we are ever going to get affordable EVs, it will be up to Proton and Perodua

Yes, it comes down to this. The fact of the matter is, no matter how you spin it, nothing will budge on this front until our national carmakers make the first move.

As much as we can say how Toyota, Honda and the like are major players in the Malaysian automotive industry, all the non-national brands combined only make up 38% of the cars sold here. Think about it, of every five new cars sold here in Malaysia, one is a Proton, and two are Peroduas. That’s how strong of a stranglehold the two brands have on the Malaysian car market.

As mentioned earlier, Malaysia is a very price-sensitive market. It’s known that we have one of the highest car prices in the world, especially if you take into account our income levels compared to other countries. As such, it’s to no one’s surprise then that what sells in Malaysia are the more affordable cars. Perodua, for instance, holds a 40% total market share with a product range that tops out at under RM75k.

The matter of having “affordable” EVs in Malaysia will have to be measured against that yardstick. Yes, for an EV to ever be considered affordable, it would have to be priced like a Proton or Perodua, but unfortunately, there are very few car companies that can do that. Proton and Perodua can, but when and how they can ever achieve this is up in the air, of course.

No, Perodua won’t be making EVs anytime soon

Perodua is at a major disadvantage here and now, solely because its partner, Daihatsu, and by extension parent company Toyota, does not have any mass-market EVs on sale today. Globally, Toyota is still pushing hard on hybrid tech, and it presently has no EV offerings even in major markets such as Europe and the United States.

Yes, it has a few EV cars sold only in China, mostly sharing tech from its local partners. But, by and large, Toyota is well behind the curve when it comes to EVs. Just over two months ago, Toyota publicly said that “it’s too early to focus only on EVs” as it prefers to keep powertrain options open for customers to choose – as in petrol, diesel, hybrid, plug-in hybrid or hydrogen.

So, expecting Perodua to come up with an EV anytime soon is unrealistic.

Proton, with Geely’s help, may get things rolling

So what about Proton, then? The national carmaker has a long history in this regard. We’ve heard of Proton working on electric cars as far back as 2009 – first. it was with Detroit Electric (remember them?), and then LG.

Collaborations soon shifted to UK-based Frazer-Nash Research, and it was even mentioned in the Malaysian Parliament (back when it was held regularly) that Proton would be selling electric cars by 2014. Naturally, that didn’t happen.

We then had the Iriz EV concept, co-developed with LG, first shown in 2014. This car had a promising 300 km range (respectable today, outstanding seven years ago), and again it was mentioned in Parliament in 2015 as being “still in prototype stage.” It was supposed to have gone on sale in 2017, priced under RM100k. We’re still waiting for it.

Now, with Geely on board, things are looking a little rosier for Proton, with EVs not looking like a pipe dream. The Chinese brand has extensive experience working with EVs, with multiple models and even EV-only brands under its far-reaching umbrella.

It now has various Geely-branded EV models, starting with the rather basic Emgrand EV sedan back in 2015, priced from RMB135k (RM87k) with local EV subsidies. Then there’s the Geometry A, a far more modern take that was recently updated to have a range of up to 600 km. Prices for this one start from RMB70k (RM77k).

There’s also the more premium Zeekr brand, which Geely says outright is “better than Tesla” in many ways. But before we get ahead of ourselves here, that’s Tesla/premium territory, and well beyond affordable EVs, which is the topic we are focusing on here.

Back to Proton. It was mentioned early on in 2017 that Geely tech will be integrated into Proton models, including hybrid, plug-in hybrid and full electric. If this is to come true, it’s likely that it would happen in that specific order, as in hybrid models to come first, followed by PHEV and then EV.

The national carmaker has yet to start on that journey as of now, but at least the path is there to be taken. However, the road isn’t a clear one.

NAP 2020 is a major roadblock for Proton EVs

Proton Edar CEO Roslan Abdullah has been very blunt on the topic of Proton EVs. “We as manufacturers cannot move until we understand the rules. If its rules and investments provide good returns for stakeholders, why not? So we need to know the rules and direction set by the government. Once the ‘door is open,’ we’ll move on,” he said in an interview earlier this year.

“How many consumers can afford an EV? In Malaysia, a part of the forces in dictating sales is price affordability. If we have to bring down the price level, would it meet certain regulations later on, if any? These are key points we are looking at in determining to bring EVs. We (need to) look for the right product and the right time,” he explained further.

It’s telling that even Proton can’t get past the NAP 2020’s ambiguity and the lack of clarity when it comes to EVs in Malaysia. Now, if Proton can’t plan ahead for its primary (some would say only) market, imagine Honda or Toyota doing that for the Malaysian market, which is beyond tiny in their grand scheme of things.

Why should Malaysians even care about EVs, when fuel is still cheap? Is running an EV cheaper than running a petrol car?

Now, if you’ve read this far, well done. This is an extremely convoluted answer to a very simple question of “where are our affordable electric cars?” But we can’t end without asking another one: why should we even bother with EVs when fuel is still so cheap?

Cost to run is a very important factor among Malaysian motorists. This goes a long way back, when Malaysians used to calculate “how many sen per kilometre.” Perhaps some people still do, especially in the lower end of the market, where fuel economy is super important to the consumer. It’s one of the biggest reasons why Perodua has dominated that segment.

Having said that, the cost to run cars here in Malaysia is significantly cheaper than in most other countries, due to the relatively cheap cost of fuel. As an example, a Myvi that averages 15 km/l (a conservative estimate) costs only 13.9 sen per km to run at the current RON 95 ceiling price of RM2.05 per litre.

Will running an EV be cheaper or more expensive? Let’s do some math, using a theoretical Geometry A-based Proton for comparison. This has a 62 kWh battery pack, and is claimed to have a range of 500 km on the NEDC cycle. Taking a heavy pinch of salt on the last figure (we didn’t take the Myvi’s claimed economy figure either) , we’d be looking at around 400 km on a full charge in real world conditions.

Using TNB’s maximum tariff rate of 57.10 sen per kWh (if you charge your car at home, you’ll surely hit the highest tariff) means it will cost you RM35.40 to fully charge the 62 kWh battery, for 400 km of usable range. That works out to just 8.9 sen per km to run an EV here in Malaysia.

So, at 8.9 sen for our theoretical EV vs 13.9 sen for the Myvi, this means that the EV is 36% cheaper to run than the Perodua. To put that into perspective, over a typical 20,000 km travelled per year (that’s an average of 55 km every single day), an EV owner would pay RM1,780 in electricity bills, while a Myvi owner would spend RM2,780 on fuel. That’s a full RM1,000 less. The more you drive, the bigger the difference will be.

Adding to this is that the Geometry A is sized comparably to a C-segment sedan, which makes its running cost being cheaper than a B-segment Myvi even more noteworthy. As with all cars, running costs will vary from car to car, so take this example as just that, an example. It’s not a Bible, as some might say.

Beyond charging/fuelling costs, there are other monetary benefits of having an EV over a conventional car. As EVs have far less mechanical parts, it requires far less maintenance too. Close to none, in fact.

There is no engine lubricant to replace periodically, and even the brake pads and discs will last far longer thanks to the electric motor’s regenerative braking taking up much of the braking duties. paultan.org ran a Tesla Model S 90D for three years without having to service the car once.

A recent service package price announced for the BMW iX suggests that EVs will be more than 60% cheaper to maintain compared to ICE cars. Final figures may vary, but it’s not an insignificant difference by any means, clearly in favour of EVs.

So, purely from a running cost perspective, it is cheaper to run an EV compared to a petrol car, even with Malaysia’s relatively cheap fuel prices. I said relative. Chill.

Of course, there are far more important reasons for choosing environmentally-friendly EVs over fossil-fuelled ICE cars, but let’s leave that for a separate article. This one is long enough as it is.

So really, where are our affordable electric cars? They’re not coming any time soon, unfortunately

But, cheaper running costs or not is all irrelevant to us as, if you’ve followed the whole story, you’d understand that we are a long way off having EVs here in Malaysia, at least affordable ones. This is a vicious cycle that Malaysia has been dragged into, solely by not doing anything.

We have no clear EV policies moving into the future, and that has led to car manufacturers piling investments into our neighbouring countries. This means that major parts will have to be imported in (less local content) if carmakers eventually decide to CKD EVs here, meaning they would get fewer incentives to do so.

The end result will be more expensive EVs here in Malaysia, at least compared to their petrol equivalents. And as we’ve established, Malaysian comsumers are demanding. Very demanding.

Having to pay more money to adopt a still-unproven technology would be a tough ask. Really, based on comments online, what a “typical” Malaysian buyer really wants is an EV that looks and performs like a Tesla Model 3, have a range of around 1,000 km, be able to be fully charged in five minutes and be priced no more than a Honda City.

Oh, and that’s only after we have public chargers (FOC of course) available every 500 metres or so. Also, would be best if it has a Honda badge too. Proton or Perodua mana kelas bro? Even then, it’s probably no guarantee of a sale, because someone is surely going to bring up the “battery replacement mahal wei” argument (no, we’re not going there now).

If it all sounds like a difficult plug, it is, but until policies and mindsets change, that’s how it will continue to roll.